Risk unique to a firms management. Landing to people to buy house who are at greater risk of being unable to meet the repayment describes subprime mortgage lending because of great practice in America before 2007 because the price of the house was increasing significantly.

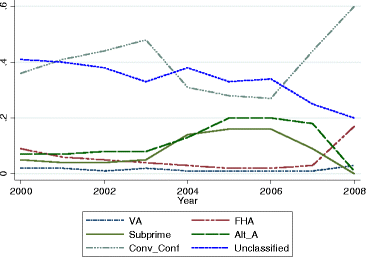

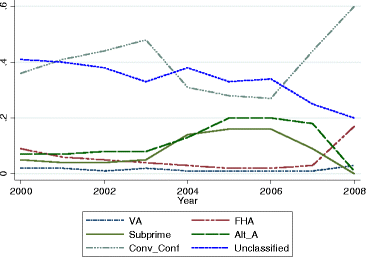

Fha Vs Subprime Mortgage Originations Is Fha The Answer To Subprime Lending Springerlink

See the answer See the answer done loading.

. The interest rate on subprime and prime ARMs can rise significantly over time. Underwriting is the process of evaluating both the borrower and collateral to ensure that lender guidelines are met. Quite often subprime borrowers have been turned down by traditional lenders.

Subprime loans are still being made today even in California. Education and research are key to avoiding predatory loans. The higher interest rate is intended to compensate the lender for accepting the greater risk in lending to such borrowers.

The periodic payments do not fully amortize the loan by the end of the term. Based on this information which of the following statements is not correct. Consider a coupon bond that sold at par value two years ago.

Subprime loans are sometimes made to low-income and risky borrowers B. An individual securitys total risk. The subprime mortgage boom in the years leading up to 2008 was arguably an example of predatory lending.

B True as long as the applicant consents and can access the information. A type of lender that specializes in lending to borrowers with a tainted or limited credit history. Responsible MLOs and underwriters will want to see compensating factors such as larger down payments or secondary financing to ensure that the loan can be paid off.

To accommodate risk subprime lenders will charge higher closing costs and processing fees C. In the given scenario this price rise will most likely lead to _____. A partially amortized loan is a self-liquidating loan.

Subprime mortgages are known for their high interest rates which lenders use to offset the risk involved. Which of the following formulas best describes the value of a bond. Subprime lending is more concentrated in a smaller number of large lenders than.

The down payment will be low or not required. The interest rates are often mixed with the first two to three years at a fixed rate and the subsequent years adjusted to the fully indexed rate. Called subprime mortgages these poor credit home loans are designed to offer homeownership opportunities to consumers whose credit score may not meet the minimum standard of a traditional lender or who might have a higher debt-to.

A borrower with a 560 credit score is given a rate that is 2 above a standard rate. The correct answer is D. A subprime mortgage is generally a loan that is meant to be offered to prospective borrowers with impaired credit records.

Ad Best Home Lenders Compared Reviewed. An individual securitys total risk B. Risk that affects a.

A False this information must be given to the applicant in person. PV of bond C 1k1 C 1k2. The final payment is a balloon payment.

A mortgage loan in the amount of 50000 at a rate of 12 has been granted for a period of 30 years with monthly payments due of 51431. Get Free Quotes From Reputable Lenders. A 7 1 ARM has a start rate of 4 an initial cap of 3 and a periodic cap of 1.

These loans will remain in a lenders portfolio rather than be sold on the secondary market. A subprime mortgage is a type of mortgage that is normally issued by a lending institution to borrowers with low credit ratings. There are options to obtain mortgages for bad credit from bad credit mortgage lenders.

Lending to people who do not have a bank account Ans. The _____ is a measure of inflation that evaluates the change over time in the weighted-average wholesale values. A borrower with a 580 credit score is.

Lending to people to buy houses who are at greater risk of being unable to meet the repayments c. The lifetime cap is 8. Under The Guidance on Sub-Prime Mortgage Loans the CSBS considers all of the following to be a predatory lending practice except.

The situation worsens as the average prices increase more than 50 a month resulting in more aggressive protests from the citizens. Lending on overvalued properties d. Subprime lenders charge higher interest rates D.

Lending to people who do not have a bank account Answer. If interest rates are much higher now than when this bond was issued the coupon rate of that bond will likely be below the prevailing. Risk that affects a large number of assets C.

The interest rate will be unconventional. A borrower with a 720 credit score uses YSP to offset closing costs. Which one of the following describes systemic risk.

Which one of the following describes systemic risk. A bank lending to someone who is not one of their customers b. Low Interest Online Lenders Comparison Reviews Top Brands Free Online Offers.

43 All of the following statements are generally true about subprime lending except. Subprime lenders are predatory lenders. All of the following statements are true about a partially amortized loan except.

A subprime loan is a type of loan offered at a rate above prime to individuals who do not qualify for prime-rate loans. Which of the following may be an indication of predatory lending. This problem has been solved.

Top 5 Subprime Mortgage Lenders. A Basing a loan off the foreclosure value B Refinancing a borrower repeatedly to collect more fees C Charging higher rates too risky buyers D Using fraud or deception to sell the loan. Which one of the following best describes sub-prime mortgage lending of 2008.

Which one of the following describes systemic risk. Finance questions and answers. ECOA A mortgage broker may inform an applicant that Federal law requires the broker to ask about the race sex marital status and age by putting the information on a web site.

A The principal amount paid in the 1st monthly payment is 1431. The margin is set at 4 and the current index value has risen in the last month to 925.

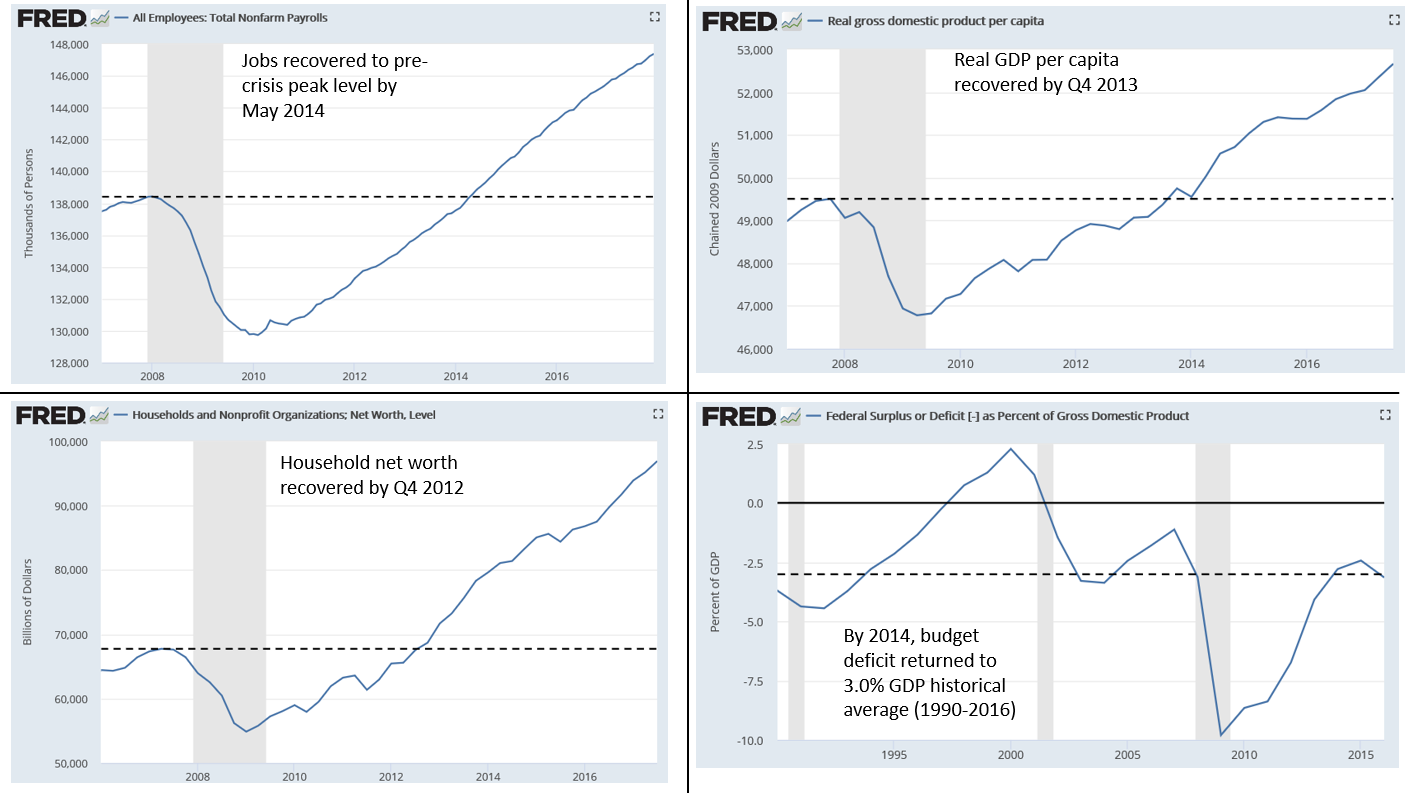

Subprime Mortgage Crisis Wikiwand

0 Comments